Under New Guidance issued by the U.S. Department of the Treasury, stock of foreign corporations owned directly or indirectly by a domestic partnership will be treated as owned proportionately by its partners for purposes of determining the amount of a partner's Subpart F income and Global Intangible Low-Taxed Income (GILTI) inclusions that are currently taxable to such partner. U.S. partners of a domestic partnership who are not U.S. Shareholders of a CFC (Minority U.S. Partners) will not have a Subpart F or GILTI inclusion.

The New Guidance is a favorable change and a reversal of the U.S. tax consequences to Minority U.S. Partners under prior law. However, as a result of this change, Minority U.S. Partners now need to be more sensitive to potential U.S. tax exposure under the passive foreign investment company (PFIC) provisions.

Background

After the 2017 U.S. tax reform (Tax Cuts and Jobs Act or TCJA), passive income and most active income of a CFC is currently taxable to the CFC's U.S. Shareholders under the Subpart F Income and GILTI provisions.1 To avoid current taxation, a U.S. person should not become a U.S. Shareholder of a CFC; however, in that case, a U.S. investor also must consider potential U.S. tax exposure under the passive foreign investment company (PFIC) provisions.

Under the law prior to the new Treasury regulations, the U.S. tax consequences to a Minority U.S. Partner who invested in a partnership that owned a foreign corporation depended on whether the partnership was formed under domestic or foreign law.

Example

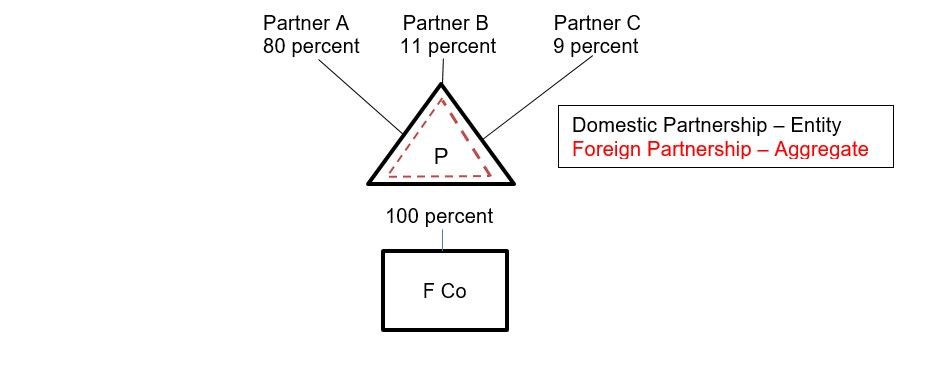

The simple example below illustrates the U.S. tax consequences under Subpart F and GILTI, pre- and post-New Guidance.

Assume: Partnership (P) owns 100 percent of foreign corporation (F Co); F Co is a CFC; and F Co derives Subpart F income and GILTI subject to inclusion by U.S. Shareholders. P has three unrelated U.S. partners: A has an 80 percent interest in P; B has an 11 percent interest in P; and C has a 9 percent interest in P.

U.S. Tax Consequences under Subpart F Rule Prior to New Guidance

If P were a domestic partnership:

- P would be treated as an entity.

- P would be the U.S. Shareholder of F Co even though it is a pass-through entity.

- P would include F Co's Subpart F income in its income.

- Partners A, B and C each would be required to include their distributive share of P's Subpart F income in their income. Note, Partner C would not have had an inclusion if the investment in F Co had been made directly or through a foreign partnership.

If P were a foreign partnership:

- P would be deemed an aggregate of its partners.

- Partners A, B and C would be deemed to own F Co by reference to their respective interests in P.

- Partners A and B each would be a U.S. Shareholder of F Co.

- Partner A would have an 80 percent Subpart F inclusion and Partner B would have an 11 percent Subpart F inclusion.

- P would not be treated as a U.S. Shareholder of F Co.

- Partner C would not have a Subpart F inclusion.

U.S. Tax Consequences under GILTI Prior to New Guidance

The Treasury and IRS had proposed a "hybrid" approach to deal with GILTI inclusions for partners of domestic partnerships to accommodate certain computational aspect of the GILTI provisions.

- U.S. partners who were not U.S. Shareholders were taxable on GILTI inclusions in the same manner as under the entity approach for Subpart F inclusions, described above. Thus, Partner C would have a GILTI inclusion.

- U.S. partners who were U.S. Shareholders of F Co (Partners A and B) were treated as having invested in F Co as though P were a foreign partnership, and would have a GILTI inclusion but, depending on circumstances, potentially could have mitigated that inclusion under the GILTI provisions.

U.S. Tax Consequences for Subpart F and GILTI Inclusions Under New Guidance

A domestic partnership owning stock in a foreign corporation is treated as an aggregate of its members in the same manner as if the domestic partnership were a foreign partnership.

Thus:

- Partners A and B each would be a U.S. Shareholder of F Co.

- Partner A would have an inclusion of 80 percent.

- Partner B would have an inclusion of 11 percent.

- Partner C would not be a U.S. Shareholder in F Co.

- Partner C would not have any inclusion.

Note: If a true foreign partnership had been used, an aggregate basis would also have applied.

Why New Guidance Was Adopted?

Stakeholders commented on the complexity and administrability of the hybrid approach. The Treasury and IRS agreed and issued final GILTI regulations adopting the New Guidance.

The Treasury and IRS also proposed to extend the New Guidance to Subpart F inclusions because: 1) the GILTI and Subpart F income regimes were intended to work in tandem, 2) substantial complexity and uncertainty would result if the two regimes were not coordinated, and 3) differing treatments would make it more difficult for taxpayers to comply and for the IRS to audit.

New Guidance Effective Dates

The New Guidance has differing effective dates, depending on its application for GILTI or Subpart F income purposes.

GILTI Inclusions

- Applies to tax years of foreign corporations beginning after Dec. 31, 2017, and to tax years of U.S. Shareholders in which, or within which, the foreign corporation's tax year ends.

Subpart F Inclusions

- Applies to tax years of foreign corporations beginning on or after the date of publication of the New Guidance as a final Treasury Department regulation, which will be a prospective date.

- However, U.S. taxpayers (Early Adopters) may elect to apply the New Guidance to tax years of foreign corporations beginning after Dec. 31, 2017, and tax years of U.S. shareholders with or within which the foreign corporation's tax year ends, provided that the New Guidance is applied consistently by the domestic partnership, its U.S. Shareholder(s) and related parties.

Some Takeaways

- Eliminates GILTI and Subpart F income inclusion exposures for Minority U.S. Partners.

- An "S" corporation is treated as a partnership. Thus, for GILTI inclusions, the S corporation is treated as an aggregate under the New Guidance. The IRS has requested comments as to the extension of the New Guidance to other pass-through entities, including trusts and estates.

- U.S. Shareholder and CFC determinations are complex. Do not overlook the complex direct, indirect and constructive attribution rules, including the new TCJA Downward Attribution provisions, which are not intuitive. A useful approach is to chart out ownership structures.

- The nontaxability of Minority U.S. Partners potentially implicates exposures under the PFIC provisions, particularly the application of the CFC/PFIC overlap rule.

- The nontaxability of Minority U.S. Partners under the New Guidance further raises 2018 compliance issues for domestic partnerships and their U.S. partners, depending on filing circumstances and the potential application of the PFIC provisions.

- IRS international information reporting requirements remain unchanged.

- Note that on July 10, 2019, the IRS issued proposed regulations under the PFIC provisions clarifying 1) the PFIC indirect ownership provisions, 2) the application of the Income Test and the Asset Test, and 3) the insurance exception. U.S. taxpayers who have potential PFIC concerns as described in this alert should review this new guidance.

For additional information or assistance with implementation of the New Guidance, contact the authors or another member of our Taxation Team.

Notes

1 A foreign corporation is a CFC when U.S. Shareholders, under broad ownership rules, own more than 50 percent of the vote or value of a foreign corporation. A U.S. Shareholder is a U.S. person who, under broad ownership rules, owns 10 percent or more of the vote or value of the foreign corporation.